E2.14 Boom-Bust Cycle

Today’s Big Question

Have the Federal Reserve’s policies dealing with the 2008 recession created a bigger boom that must bust?

Many of the popular economic “experts” that promote the inflationary policies that America has adopted have listened to the economist John Maynard Keynes. Keynes’s magnum opus, The General Theory of Employment, Interest and Money, was published in 1936. If you take macro-economics in college, much of the subject is built on Keynesian economics.

The 1974 Nobel Prize winning Austrian economist F.A. Hayek, following the Austrian Business Cycle Theory developed by Ludwig von Mises spelled out the Austrian approach in his book, published in 1929, an English translation of which appeared in 1933 as Monetary Theory and the Trade Cycle. There he argued for a monetary approach to the origins of the cycle. What you are learning about inflation is rooted in the work of Mises and Hayek.

- Watch the video: “Fear the Boom and Bust” about Keynes and Hayak.

- Read 9.3 down to the beginning of 9.3.2.

- Read Penny Candy chapter 10 (pp. 75-81).

When President Obama took office, the country was in the midst of a recession that was the result of a bubble that had been building in the real estate market since 2001. The bubble burst in 2008 and many people lost a lot of money because the value of their real estate dropped almost overnight. They suddenly had mortgages that were much larger than the current value of their property.

Government economists under both the Bush and Obama administrations were saying that no one could have seen it coming. But Dr. Cleveland, the author of your textbook, using some of the ideas you are learning about inflation and boom-bust did see it coming. He had published an article in 2005, Freddie Mac: A Mercantilist Enterprise, pointing out the problems.

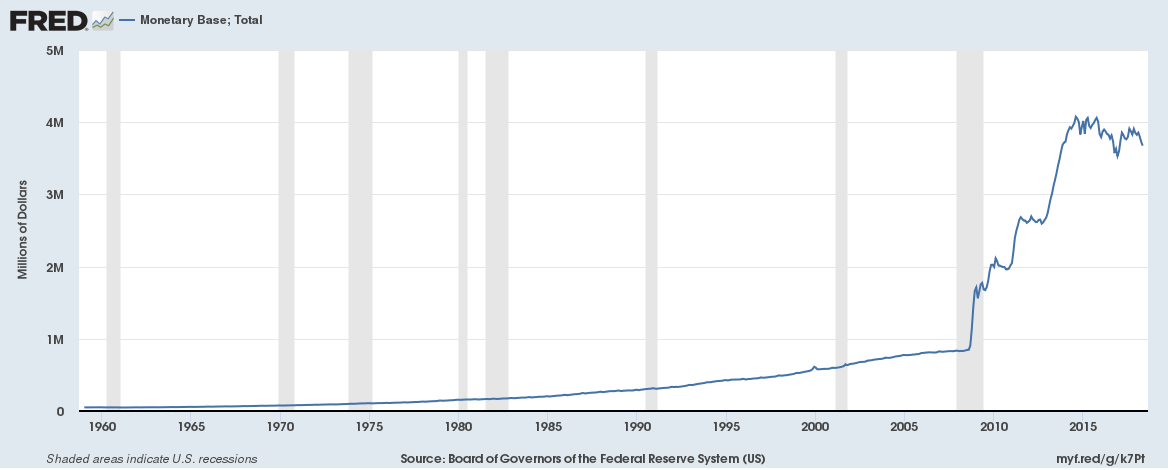

When President Obama took office, the strategy his administration adopted for ending the recession was called quantitative easing. This strategy involved using the Federal Reserve to inflate the money supply through all means available to it. This graph from the St. Louis Federal Reserve* shows what happened to the monetary base from 1960 until 2018.

- Can you see the three large “quantitative easings” that happened under the Obama administration (2009-2016)?

- Dollars on this graph are measured in millions of millions. One million million equals one trillion (1,000,000 x 1,000,000 = 1,000,000,000,000).

- How many trillion dollars were created in the monetary base from 1960 until the beginning of President Obama’s first term?

- How many trillion dollars did his administration increase the monetary base?

Some of this money has entered the market giving the impression of a strong economy. It can be seen in may places such as the stock markets where stock prices have risen faster than their true value. The money has also gone into places where government guarantees have made credit easier to obtain than it would have been in an open market, such as student loans. Some has gone into goods where government subsidies pay large portions for some people, such as Obamacare. Is there any surprise that the cost of college and health insurance have skyrocketed?

Much of this new money has remained in the commercial banking system as excess reserves since these banks are being paid interest to merely hold on to the money. What do you think will happen if this money begins to flood into circulation?

*The St. Louis Federal Reserve maintains a large amount of economic data and makes it available for research. Anyone can go to their website and build graphs from any of the data.

A pdf of the study guide for Chapter 9 from the textbook is available below if you need a copy. When viewing in full screen, hit ESC to return to this screen.